Empowering Senegalese youth through access to digital financial services

By Sabine Mensah, Regional Technical Specialist, and Bery Dieye Kandji, KM Consultant in Senegal.

For more information, contact:

Or visit:

Tags

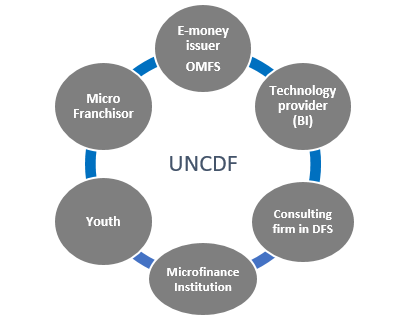

The ecosystem of partners involved in the project.

M-Dorado, one step further!

Thanks to the Youth Agent project, 26-year-old Aby Ndour, from the Saly Joseph district of Mbour, Senegal, greets each morning with new vigor. "In September 2017, I was selected as one of the participants in this project. It was an unexpected opportunity. My husband died few months ago leaving me with two small children. I have been getting by on income earned from doing odd jobs like cleaning and sales. But it’s nothing fixed. With this new opportunity, I now have the chance to put my business skills to use. I can’t wait to get started”. Aby is one of fifteen young people recruited to join the first phase of the Youth Agent project; just like Ndeye Fatou Ndiaye, a 30- year-old mother of five and Aboubacar Gueye, a 29-year old single male. What do they all have in common? They are young, unemployed, desperate to find ways to make ends meet, and willing to seize any opportunity that presents itself.

The United Nations Capital Development Fund (UNCDF), through two of its seminal programs, MM4P and YouthStart, is partnering with the mobile network operator Orange 1 to launch the ‘Youth Agents in Senegal’ project. This partnership dual objective is to increase financial inclusion through the extension of digital financial services (DFS) in Senegal and to promote the employability of young people through entrepreneurship.

A new partnership model for young entrepreneurs

The Youth Agents project has been designed using a micro-franchising model. It uses the 'business in a box’ approach which links companies who target new customer to high-potential, young entrepreneurs who lack the capital to develop their own business initiatives. Each young recruit is equipped with a kiosk to enable him/her to offer DFS such as selling airtime, cash in /cash out and mobile phone products sales. The kiosk is financed by a loan granted to the young entrepreneur by a participating financial institution. A typical loan amount is above CFA 600,000 (approximately US$1100). A franchisor serves as a guarantor for this loan. Access to funding is the key step in the process of youth empowerment, as it is the only means by which they can actualize their dream of becoming an entrepreneur. As a sign of commitment, each youth entrepreneur is required to put up CFA40,000 (approximately US$72), of which CFA15,000 (approximately US$27) go towards opening an account at lending financial institution.

The two-year project has been embraced wholeheartedly by young people in both the suburban and rural areas of Senegal. Abdoulaye Gueye said: “I am the eldest of my family and my father is retired. I must now take over caring for the family. In Mbour it is not easy to find work. When I was recruited to serve as a supervisor for this project, I was given a monthly salary of CFA80,000 (approximately US$145). With this fixed income, I am in a better position to help my family. I intend to seize all the opportunities that will arise during this project.”

The partners engaged toward youth employability

UNCDF and its partners decided to capitalize on the affinity young people have for new technologies to promote youth employment and contribute to their financial inclusion. The project brings together several actors to advance the DFS ecosystem:

- The MM4P programme, funded by the Mastercard Foundation, is a UNCDF initiative launched in 2012 to help low-income households improve their financial security through the provision of digital financial services;

- YouthStart is UNCDF programme launched in 2010 to increase access to funding for the youth, supporting service providers in the design and development of both financial and non-financial services for young people;

- Orange through its subsidiary e- money issuer OMFS 2 , and beyond the need to broaden its customer base, intends above all to participate in the financial inclusion of young people by sharing its expertise on entrepreneurship;

- A micro franchiser responsible for recruiting, training and monitoring Youth Agents;

- A microfinance institution partner of the micro franchisor, to enable young people to open accounts and receive funding;

- Amarante Consulting, a consulting firm specialized in the development of DFS distribution network to provide technical assistance to the micro franchisor in terms of good practice in managing agents;

- A firm specializing in digital platform development to create a Business Intelligence application with which young entrepreneurs will manage their business and better know their customers.

New opportunities for digital financial services in Senegal

To test the model, the project will deploy fifteen pilot kiosks, learn from them what works and what doesn’t and subsequently, improve the partnership model. The goal is to set up 150 kiosks for young people in suburban and rural areas of Senegal by April 2018. Beyond providing employment opportunities for young people, the project supports the development of the distribution of DFS, especially in peri-urban and rural areas. The first kiosks will refine the key elements of the project, such as:

- The recruitment and training strategy for the youth

- The financing mechanism for the youth

- Agent network and liquidity management models

- The performance of young people in the micro franchising for DFS

- The impact of the Youth Agents project on the adoption of DFS

As ambassadors of mobile technologies, the ‘young agents’ can be a powerful driver for the adoption of innovative financial services in their communities.

The ecosystem approach used in this project, which put together multiple partners, can be utilized to leverage high volume payments from the Government or NGOs (such as salaries, pensions, allowances, scholarships) in areas where populations do not have access to DFS. There is a myriad of perspectives that make this project a great step forward on the road to M-Dorado, the paradise for DFS.

Pour lire en français, cliquez ici.

1. Orange provides digital financial services under its entity Orange Finance Mobile Senegal (OFMS)↩

2. Orange Finance Mobile Senegal↩